chapter 7 bankruptcy - An Overview

Contrary to Chapter seven bankruptcy, Chapter 13 doesn’t get rid of most debts. Nevertheless it does give borrowers a break from assortment endeavours and may halt moves by creditors to get your private home, motor vehicle or other residence.

The trustee or maybe a creditor could object to the approach at or following the 341 Conference. In many scenarios, challenges are resolved informally. If not, a modification needs a written objection requesting a courtroom ruling.

Consider no matter if you have an excessive amount debt. When you don’t qualify for Chapter 13, take into account on the lookout into other debt relief selections.

Bankrate follows a rigorous editorial plan, to help you have confidence in that we’re Placing your passions first. Our award-successful editors and reporters make sincere and exact content material to help you make the correct financial choices. Key Principles

Your trustee will Arrange a gathering concerning your self as well as your creditors. Bankruptcy judges are unable to attend.

These supplemental aspects allow for our attorneys to gain a further understanding of the details of the case

Once more, the ideal efforts rule is at function. Unsecured creditors will have to get a minimum of an total equivalent to the value of your nonexempt property. Usually, the Chapter 7 trustee will promote the nonexempt home and shell out unsecured creditors.

When you undergo mandatory credit history counseling, your counselor may possibly give you a debt administration program instead to bankruptcy.

Having said that, this doesn't influence our evaluations. check out this site Our views are our own. Here is a list of our partners and Here is how we generate profits.

Did you know Nolo has built the law straightforward for over fifty several years? It truly is true—and we want to ensure you find what you will need. Underneath you will discover much more posts explaining click resources how bankruptcy operates. And don't forget that our bankruptcy homepage is the best area to begin For those who have other inquiries!

Your financial debt is frozen. All credit card debt on unsecured promises are frozen the day you file for Chapter 13. What this means is payments you make towards your creditors are used Will I Lose My Tax Refund When Filing Bankruptcy to shell out down personal debt rather than getting eaten up by desire and late fees.

Your debts are reorganized, and also a software is about up to pay them. You ought to be in a position to keep your home just after Chapter 13 bankruptcy provided that sites you meet up with the requirements in these details the repayment strategy set up by the bankruptcy court.

It might take nearly seventy five days with the court docket to approve your Chapter 13 bankruptcy case. Once you’re permitted, you’ll have three to 5 years to repay your eligible debt.

Chapter thirteen is usually a type of bankruptcy that allows debtors to restructure their debts and shell out them off more than a period of a few to five years less than courtroom supervision.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Val Kilmer Then & Now!

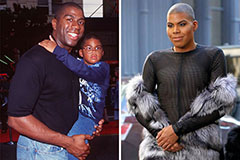

Val Kilmer Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!